CSV file template and template for single file uploads.

CSV file template.Įmployer agents who bulk file (ICESA) should start using the new specifications for bulk wage filing. Employer agents who link to the clients and use single file uploads should switch to the new. Learn more about WA Cares reporting.Įmployers reporting via file upload (.CSV) should use the updated. NOTE: Beginning July 1, 2023, employers will collect WA Cares premiums from employees the same as for Paid Leave-ESD is updating the Paid Leave reporting system so employers can report for both programs at the same time. Looking for instructions on creating your.If a third-party employer agent will be reporting on your behalf, confirm that they will be submitting reports.Updated the payroll tables from July 1 st, 2019 to December 31 st, 2019. The best accounting software helps you create invoices, record incoming and outgoing payments, identify and follow up on past-due receivables, and run reports that help you analyze your financial. CSV file, make sure to test it before uploading it. Investment Incentive Program (AIIP) Added a new checkmark to. ( Download the instructions for creating a.

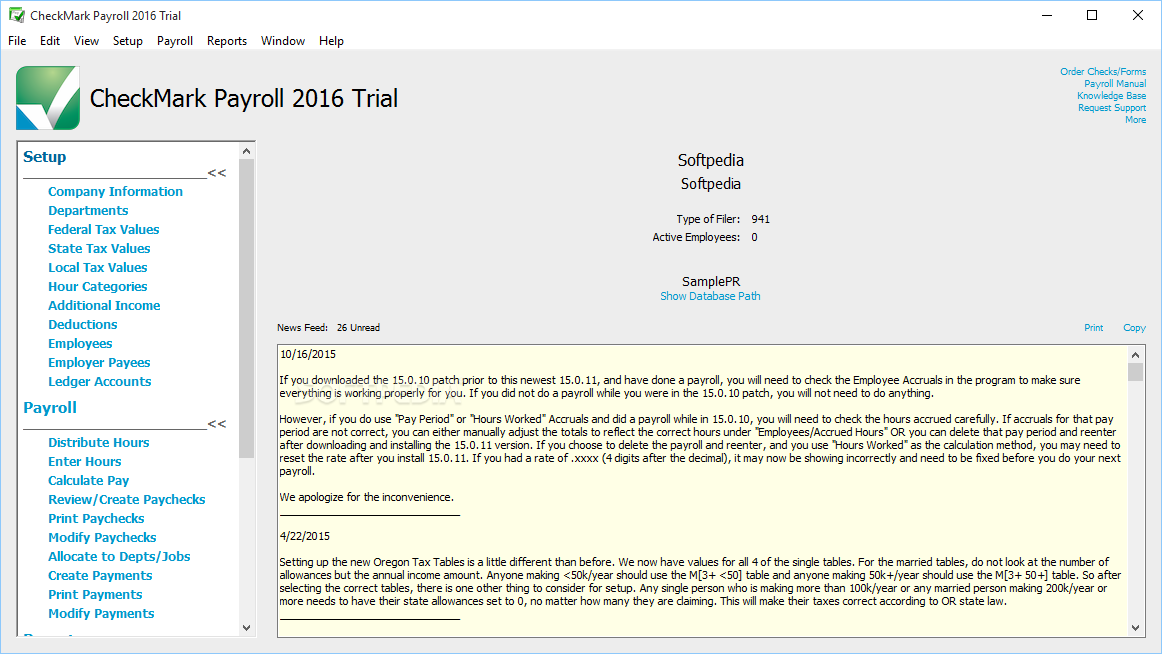

CHECKMARK PAYROLL SOFTWARE 2019 UPDATES MANUAL

(If you don’t know your UBI number, look it up.)

CHECKMARK PAYROLL SOFTWARE 2019 UPDATES HOW TO

( Create an account if you don’t already have one, and watch this video to learn how to set up your account.) This includes the software, updates and tech support.

0 kommentar(er)

0 kommentar(er)